The original "Traditional Medicare" Plan (Medicare Part A & B) is available everywhere in the United States. It is the way everyone used to get Medicare benefits and is the way most people get their Medicare Part A and Part B benefits now. You may go to any doctor, specialist, or hospital that accepts Medicare.

The Traditional Medicare Plan pays its share and your supplemental FEHB coverage often pays the difference and if you carry both Part A and B most FEHB plans waive the deductible, copayments and coinsurance. Some things are not covered under Original Medicare, like prescription drugs.

Monthly Part B premiums increased to $202.90

Monthly Part B premiums increased to $202.90

in 2026

![]()

Usually monthly premiums for Medicare Part A (Hospital Insurance) are free if you or your spouse paid Medicare taxes while working. This is referred to as "premium-free Part A." If you don't qualify for Part A, the 2026 premium is either $311 or $565 each month, depending on how long you or your spouse worked and paid Medicare taxes.

Most people get Part A without having to pay a premium. Premiums for Part A are free at 65 if:

If you're under 65, you can get premium-free Part A if:

In most cases, if you opt to purchase Part A, you must also take Medicare Part B and pay a monthly premium for both.

For more in-depth information on Medicare B including information and Tricare for Life read What to Consider Before Enrolling in Medicare B (Part 2) Also read the article titled Should You Change to a Lower Cost FEHB Plan When You Sign Up For Medicare.Medicare Part B & D premiums are determined by your Modified Adjusted Gross Income (MAGI). The more you earn the higher your Part B and D premiums. For most beneficiaries, the government pays a substantial portion—about 75 percent—of the Part B premium, and the beneficiary pays the remaining 25 percent. If you’re a higher-income beneficiary, you’ll pay a larger percentage of the total cost of Part B and D based on the income you report to the Internal Revenue Service (IRS). You’ll pay monthly Part B premiums equal to 35, 50, 65, or 80 percent of the total cost, depending on what you report to the IRS. Generally, your Modified Adjusted Gross Income (MAGI) is the total of your household's Adjusted Gross Income plus any tax-exempt interest income you may have (these are the amounts on lines 37 and 8b of IRS from 1040).

If you are not receiving social security benefits, you can have Medicare premiums withheld from your annuity payments. OPM must receive a request for the withholding from the Centers for Medicare and Medicaid Services. They cannot withhold premiums based on your direct request or even one from the Social Security Administration. However, the social security district office may be able to give you additional information.

Medicare phone number: 1-800-MEDICARE (!-800-633-4227)

Medicare

Advantage Plan Primer – What You Need to Know

Medicare

Advantage Plan Primer – What You Need to Know

The decision to enroll in Medicare is yours. OPM encourage you to apply for Medicare benefits 3 months before you turn age 65. It's easy. If you do not apply for one or more Parts of Medicare, you can still be covered under the FEHB Program. Visit their website for forms and additional information.

If you can get premium-free Part A coverage, OPM advises you to enroll in it. Most Federal employees and annuitants are entitled to Medicare Part A at age 65 without cost. When you don't have to pay premiums for Medicare Part A, it makes good sense to obtain coverage. It can reduce your out-of-pocket expenses as well as costs to FEHB, which can help keep FEHB premiums down.

Everyone is charged a premium for Medicare Part B coverage. The Social Security Administration can provide you with premium and benefit information. Review the information and decide if it makes sense for you to buy the Medicare Part B coverage. For additional information on Medicare B here is list of articles that will help you decide:

If you are eligible for Medicare, you may have choices in how you get your health care. Medicare Advantage is the term used to describe the various private health plan choices available to Medicare beneficiaries. The information in the next few pages shows how we coordinate benefits with Medicare, depending on whether you are in the Original Medicare Plan or a private Medicare Advantage Plan.

Consider Lower Cost FEHB Plans When Signing up for Medicare

Consider Lower Cost FEHB Plans When Signing up for Medicare Usually monthly premiums for Medicare Part A (Hospital Insurance) are free if you or your spouse paid Medicare taxes while working. This is referred to as "premium-free Part A." If you must buy Part A, it will cost you up to $411 each month.

Most people get Part A without having to pay a premium. Premiums for Part A are free at 65 if:

If you're under 65, you can get premium-free Part A if:

In most cases, if you opt to purchase Part A, you must also take Medicare Part B and pay a monthly premium for both.

More than 71 million Americans will see a 2.8% increase in their Social Security benefits and Supplemental Security Income (SSI) payments in 2026. This includes federal annuitants under the Federal Employees Retirement System (FERS) and Many under the old Civil Service Retirement System (CSRS).

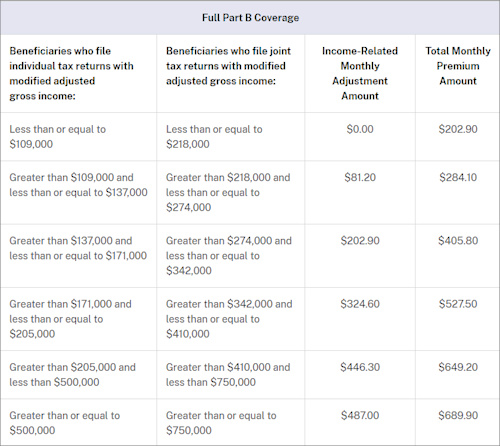

If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Medicare has not officially published the brackets due to the government shutdown. These are estimates for 2026.

Medicare 2026 Part B IRMAA Brackets

There are separate Part B income-adjusted rates for:

high-income beneficiaries who only have immunosuppressive drug coverage

Premiums for high-income beneficiaries with full Part B coverage who are married and lived with their spouse at any time during the taxable year but file a separate return, and for

Premiums for high-income beneficiaries with immunosuppressive drug only Part B coverage who are married and lived with their spouse at any time during the taxable year but file a separate return

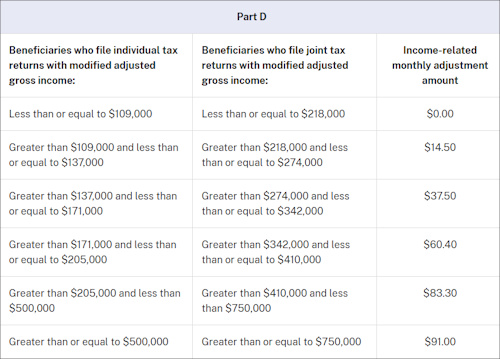

A beneficiary’s Part D monthly premium has been based

on his or her income. These income-related monthly adjustment amounts affect

roughly 8 percent of people with Medicare Part D. These individuals will pay

the income-related monthly adjustment amount in addition to their Part D

premium. Part D premiums vary per plan regardless of how a beneficiary pays

their Part D premium, the Part D income-related monthly adjustment amounts

are deducted from Social Security benefit checks or paid directly to

Medicare.

Medicare Part D Income - 2026

Monthly Adjustment Amounts

There are

separate Part D income-adjusted rates for Premiums for high-income

beneficiaries who are married and lived with their spouse at any time during

the taxable year but file a separate return.

Your Medicare claim number is your Social Security number followed by one of the suffixes listed below. The suffix identifies your benefit status.

If you are retired military or a military spouse and

have TriCare you must sign up for Medicare Part B in the 3 months before

turning 65 in order to continue with

TriCare for life. TriCare participants are able to

suspend their FEHB enrollment if they wish after retiring from federal

service; federal employees can't

suspend FEHB coverage while still working.

The time you had with TriCare counts towards the 5

years of FEHB coverage that participants must have to carry FEHB coverage

into retirement and you must be enrolled in a FEHB plan at retirement to be

able to suspend it. If you choose to stay with TriCare and suspend FEHB

participation as a civilian retiree, you can sign back up for FEHB during

any subsequent open season should you need private insurance coverage. This

would be desirable if health care providers are not taking new

Medicare/TriCare patients when you move to a new location or otherwise lose

your doctor. "

If you are retired and receiving Social Security you will automatically be enrolled in Part A and B and should receive your Medicare card three months before your 65th birthday. If you decide not to take Part B follow the instructions that you receive with your enrollment package.

If you aren't receiving Social Security you have a 7 month Medicare enrollment window that starts 3 months before your birthday. You can sign up online at https://www.socialsecurity.gov/medicare/apply.html or you can visit your local Social Security Office to apply. Call 1-800-772-1213 for additional information and assistance. You can also sign up for Medicare at https://www.medicare.gov under the "New to Medicare" section. It takes about 15 minutes to register and sign up online.

If you sign up the month you turn 65 or during the last 3 months of your Initial Enrollment Period, your coverage starts the first day of the month after you sign up.

If you are retired but covered under a working spouse’s medical plan or you are still working, sign up for Part A and then advise them that you do not want part B because you are covered by your employer or under a working spouse plan as the case may be. All current federal employees and those retirees with new employer health care coverage or are covered under their spouse should elect this when they turn 65 to delay Part B without penalty until their working spouse retires, or they leave federal service, or their new employer.

You can withdraw from Medicare Part B at any time if desired. Once you withdraw from Medicare B you would have to notify your FEHB provider, Blue Cross Blue Shield in your case, immediately because they would revert back to primary provider for medical services. To cancel Medicare Part B coverage you will have to use form CMS-1763. This form isn’t available online and you must contact your Social Security Administration office to complete the form. They will discuss the consequences of canceling your coverage, including how penalties are accessed, and process the form for you over the phone. The Social Security FAQ titled How do I terminate my enrollment with Medicare Part B when I have other health insurance explains the process in more detail. Typically your monthly premium for Part B may go up 10% for each full 12-month period that you could have had Part B, but didn’t sign up for it.

If you are eligible for Medicare and not eligible for Social Security, you can have Medicare premiums withheld from your annuity payments. OPM must receive a request for the withholding from the Centers for Medicare and Medicaid Services. They cannot withhold premiums based on your direct request or even one from the Social Security Administration. The request must come from the Centers for Medicare and Medicaid Services (CMS) to withhold Medicare premiums from annuity payments.